MC loans are given to small-scale economically active low-income groups and business people. Such loans shall be secured by Co-guarantor ship and the group members shall have a common bond (interest) and must have income generating projects. Micro-credit shall operate independently from all activities of FOSA and BOSA. However, MC affairs shall be dealt with by the investment/micro credit Committee of the SACCO.

Eligibility for loan

All Micro credit customers are eligible to apply for a loan provided that:-

1. An initial period of 8 weeks of uninterrupted savings and training has been completed.

2. All meetings over the period have been attended by the members and the MC field officers to supervise savings collections and prepare members to familiarize with the loaning procedures.

3. Members comply with the SACCO regulations and their respective group by-laws.

4. The loan disbursement criteria shall be on 1:1:1: ratio i.e. 1/3 of the members to receive loan after 8 weeks and the subsequent 1/3 of the members to get loan after 4 weeks respectively.

5. Subsequent loaning of the 2nd and 3rd lots is dependent on the repayment record of the 1st borrowers.

6. The purpose for the loan shall be business financing (working capital).

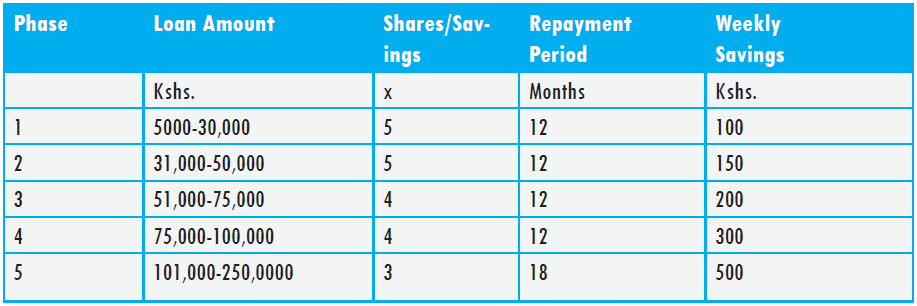

Phases of Micro credit Loans

Trans Nation

Trans Nation